I’m sending out this newsletter just as I’m about to hop on a flight to head to Washington, DC for #B1June. If you’re in DC for the event this weekend, make sure to let me know! While I’ve been trying to do this newsletter bi-weekly, I might send out an update next week to talk about the B1 event, provided there’s exciting enough news. If you want to follow the action live, the good folks at EOS New York and Everything EOS will be doing live updates in their Telegram channels.

As always, feedback and suggestions for the newsletter are welcome! You can find me on Twitter.

Myles Snider

One of the major discussions that kicked off a couple weeks ago revolved around changing the way voting works on the EOS mainnet to a new system called 1 token 1 vote (1T1V). While the idea has been floated for quite some time, the debate was reignited by a tweet in which Brendan Blumer said he believed it was the right path forward for EOS.

Currently, every EOS account can vote for up to 30 block producers. If I have 1000 EOS, then I can vote for 30 BPs, each of whom receive 1000 votes. Votes are tallied and BPs are ranked by total number of votes received (approval voting). One of the benefits of this system is that it allows for “co-opetition” among BPs. They are happy to work together on various projects, knowing that any given voter could support both of them for their efforts. But it also encourages vote buying and trading. Any given whale can spread out their voting power among 30 different entities, potentially collecting kickbacks from those BPs.

1T1V changes this up significantly. Instead of giving each account 30 BP votes, it would give each account only one. If I have 1000 EOS, then I can only vote for a single BP, who then gets 1000 votes from me. If I wanted to support multiple BPs, I’d have to split my EOS into different accounts. I could create two accounts with 500 EOS each and vote for a different BP from each account, but now each of those BPs would only receive 500 votes. This would make it harder to do vote buying or vote trading, since each BP added to one’s votes would decrease the total amount of voting power allocated to each.

Switching to 1T1V would be a pretty major change to the EOS governance model, but I tend to agree with Blumer that this would be a positive change for the network. That said, this wouldn’t be an easy change to implement, and it seems more likely that new EOSIO chains will launch with this model than seeing this happen on the mainnet in the short term.

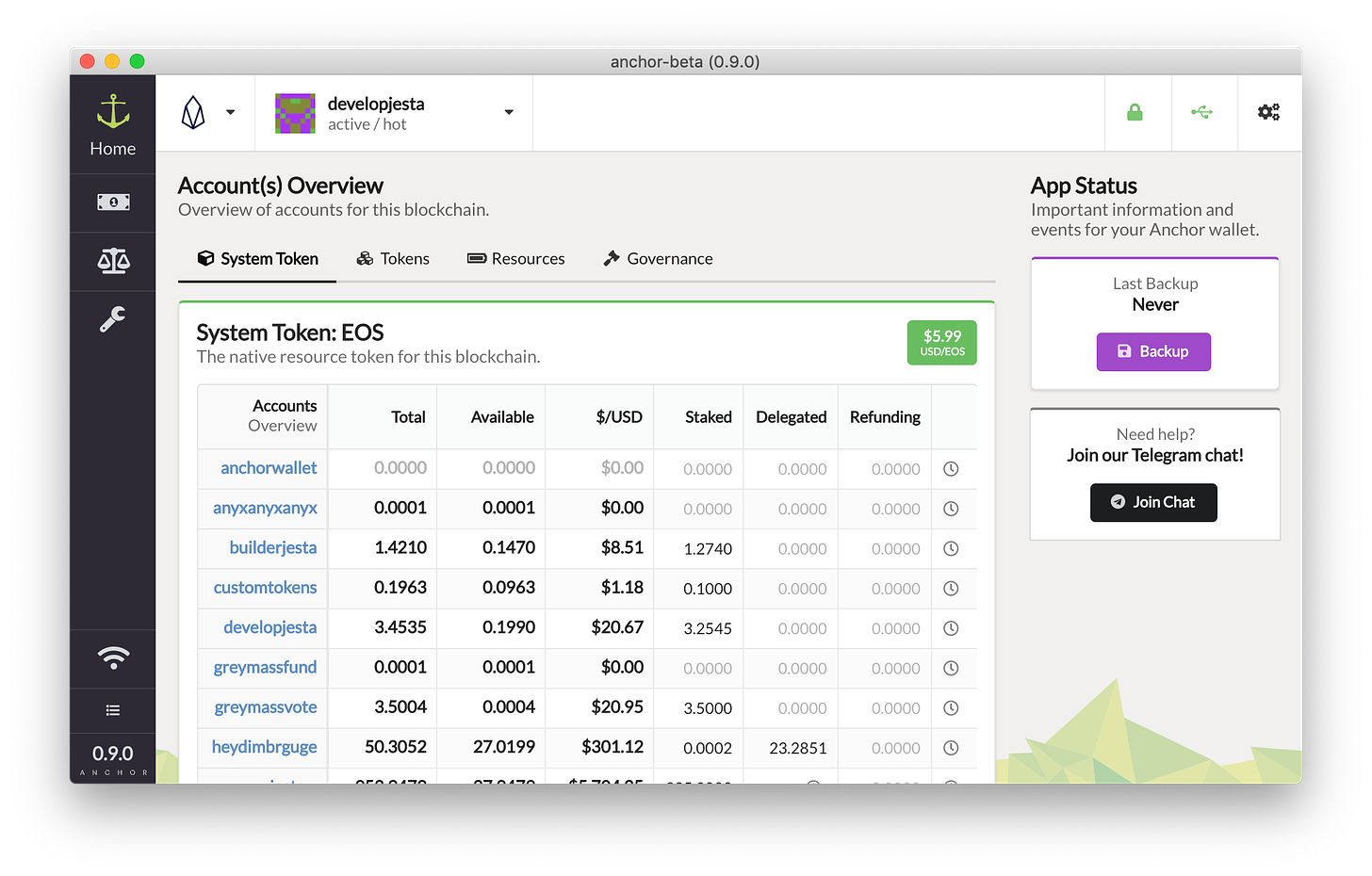

Here at Greymass, we’re super excited to release the beta version of Anchor, the successor to the eos-voter desktop wallet. Aaron, Daniel, Johan, and Scott have been working on this product since long before I joined the team, and it’s quite impressive. I’ve been a user of the eos-voter wallet since mainnet launch. It integrates super well with my Ledger, and it makes participating in governance quite easy. Anchor not only includes new branding, a new interface, and a bunch of fantastic new features, but it also introduces a new signing protocol that will allow you to use Anchor (or any other compatible wallet) to interact directly with dApps and services.

You can now download and play around with the beta version (link here). It won’t interact with or override your current eos-voter installation, so don’t worry about it affecting your legacy wallet. If you have feedback, feel free to join the Anchor wallet Telegram channel or the Anchor developers channel.

Finally, check out our Greymass team update, with more info on Anchor and all of the other things we’ve been working on lately!

A recent Bloomberg article about Block.one offered some really interesting details into Block.one’s capital structure. A few quick facts:

B1’s assets totaled about $3B at the end of February 2019

B1 has a mega-bag of BTC, holding as much as 140,000 BTC at one point

They hold $2.3B in “liquid fiat assets,” most of which are US government treasury bonds

EOSVC has made $147M in investments to date

Perhaps even more interestingly, B1 bought back equity from its early investors at a 6,567% return. Yes, you read that right. One of the early investors whose shares were purchased was Mike Novogratz, who was the highest-profile early public backer of B1. Novogratz later clarified in a tweet that Galaxy Digital still holds both B1 equity and EOS tokens, but they decided to take profits after B1’s equity vastly outperformed their other holdings in the bear market.

The BTC component is actually the most interesting to me here. A few months ago, Dan and Brendan spent a lot of time on Twitter talking cryptically about how EOSIO could be used to scale Bitcoin. If they are actually building a product they think will benefit Bitcoin, they could stand to benefit greatly from such a large position. I’d love to see BTC and EOSIO tech come together in some compelling way.

Ahead of their June 1st announcement event, Block.one made some interesting moves with their EOS stake for the first time since mainnet launch. First, they unstaked 9.8M EOS, with Dan commenting on Telegram that they had no current plans to sell EOS and that the move was “to facilitate new internal policy and strategic initiatives.” As usual with Dan, he was light on details and that could mean just about anything.

Just a few days later, B1 purchased 32GB of RAM on the mainnet, spending 3.3M EOS to do so (the RAM trading fee ended up being 16,500 EOS, which went straight to the books of the REX— great time to be a REX lender). What does this mean? Well, nobody knows for sure, but it does strongly signal that B1 is doing something on the mainnet. A lot of the rumors going into B1June were that B1 was planning to launch a new EOSIO chain for their social media project, perhaps with an airdrop to current EOS holders. Brendan put the airdrop rumor to rest on Twitter, which seems to further signal that they’re not focusing on building out another blockchain at the moment.

Purchasing that much RAM on the mainnet strongly signals that B1 is planning to build something there. Some are speculating that they will deploy their social media product (or at least a proof of concept of some sort) directly on the mainnet as a dApp. Others have speculated that B1 has some sort of inter-blockchain communication (IBC) solution they’re ready to deploy, and the RAM is needed to build IBC hubs on the mainnet. Given everything we’ve heard from Dan and Brendan lately, I’d say the social media product seems far more likely. The good news is that we only have to wait until tomorrow to know for sure!

Block.one’s EOSIO Labs initiative just published some open-source example code for an iOS signature provider app, as well as a Google Chrome extension. From the article:

The EOSIO Reference iOS Authenticator App is an implementation on iOS that allows users to sign in and approve transactions from 1) web applications running in Mobile Safari and 2) other native iOS apps on the same device. Key management and signing take place in Apple’s Secure Enclave and/or Keychain and are protected with the device’s biometric authentication.

B1 talked for a long time about building an EOS iPhone wallet, and then later said they’d simply release their code as an open-source template that other developers could use. I’m really excited to see who takes this and introduces it into an app that actually gets through the App Store. Using TouchID/FaceID + Apple’s secure enclave feels like the future of key management. You can read more about the project here.

Everyone who has been following the crypto space for the past year has seen the explosion of the Open Finance/DeFi narrative. This narrative really came from within the Ethereum community and has been closely tied to that chain— mostly because of a few key projects like Maker, 0x, Compound, Dharma, Uniswap, etc. Many have called DeFi Ethereum’s “killer app,” and the community has really latched onto that as a meme and narrative.

What is DeFi, exactly? Different people likely have different definitions. In my opinion, DeFi is hardly limited to Ethereum. Bitcoin is DeFi. Bitshares/bitUSD are DeFi. And although some have criticized EOS for not having a similar critical mass of DeFi applications as Ethereum, I disagree with the argument. First, it’s early. Many of the Ethereum projects listed above didn’t go live until several years after Ethereum was built. “DeFi” didn’t even exist as a real narrative in Ethereum’s early days. EOS still needs time to build some of these critical pieces of infrastructure. Second, I think some people just choose to ignore the clear DeFi applications that exist on EOS— REX, Chintai, NewDEX, WhaleEX, and a few others.

Most notably, however, is the recent uptick in REX usage. One of the metrics most often used to gauge the success of DeFi applications is the amount of value (usually measured in Ether) that’s “locked” in DeFi apps. A site called DeFi.Review has been collecting a bunch of data there. With ~$700M worth of EOS locked up in REX, it’s one of the biggest DeFi applications out there. I expect this growth to continue, and fully expect to see stablecoins, DEXs, and more thriving on EOS in the near future.

EOSIO Labs - Native SDKs for Swift and Java

EOS DNS by EOS Cafe Block and EOS Name Service

RAM Usage Tracker by dfuse Labs

Introducing TokenYield.io

Decentium - Censorship-Resistant Medium Alternative Built on EOS

EOS Mainnet Drifts Eastward - EOS Weekly

EOS DNS, airHODL, StrongBlock, and more on Everything EOS

Support This Newsletter

If you want to support this newsletter, you can do so in two ways: cast a vote for teamgreymass, or send us a donation to eosvoter.x

Your support is much appreciated!